Cryptocoin Project Insurance

are financial derivatives sold by option authors for option buyers. The contract offers the buyer the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at an agreed price over a specified period of time or on a specific date. The agreed price is called the strike price. There are many types of options. One option can be done at any time before the option expiration date, while other options can only be done on the expiration date (training date). Exercising means using the right to buy or sell the underlying security.

Sounds very difficult! That is why this project is divided into two parts: option exchanges and insurance companies:

Traders and hedge funds conclude stock option purchase and sale transactions

Other clients, who don’t want to know how to work options can buy insurance for the growth or fall of the main crypto currency.

Cryptocoin insurance has two main sources of income

Exchange of

Profit Options are generated as trading commissions from each operation on purchase or sale options. This is 0.5% per transaction or 1% per circle for each transaction party.

Taking into account the volatility of options and great opportunities to make a profit, this commission is not significant for market participants. However, this allows exchanges to earn high income compared to the usual cryptocurrency exchanges due to lack of competition. In the case of future competitors, the amount of the exchange commission can be reduced proportionally.

This Income Insurance Company is generated by selling growth / decline cryptocurrency insurance.

Problem:

There is no solution to ensure the deposit on Bitcoin or Ethereum does not fall.

At the same time in this market there is an increase in volatility that makes people afraid to save large funds in cryptocurrency. On the other hand, large companies are slow to enter the market (for example, to receive payments in cryptocurrency) for the same reason.

There is no special cryptocurrency exchange where you can buy / sell options.

The main fear of creating such a stock exchange is increasing volatility as well. It seems everyone who deals with options for stocks, oil or wheat that the risk is very large.

There is still no short sales opportunity in the cryptocurrency market.

No one can sell cryptocurrency that is physically not in the account in a short time. This reduces the ability of speculators to smooth price fluctuations in other markets. In turn it causes an increase in volatility and the consequences mentioned in the clause. 1 and 2 above.

Solution:

CRYPTOCOIN INSURANCE allows you to ensure falling prices or growth risks for major cryptocurrency.

CRYPTOCOIN INSURANCE creates the first option exchange.

Options allow short sales.

How it works The

price of each option at a given time is under the influence of supply and demand and continues to change. The option risk buyer is only the amount spent buying options, for example, $ 100. They cannot lose more in other circumstances. Option sellers theoretically carry unlimited risks related to changes in prices of basic assets (Bitcoin or Ethereum). That is why each option sale is equipped with a security guarantee (GS).

Security guarantees are the amount (margin) required by the exchange as collateral for the option seller to fulfill his obligations. GS is established by the exchange in a fixed amount as on a specific date and for one option contract. GS values are indicated in this contract specification.

By selling options, the seller immediately receives the premium paid by the option buyer. Exchange freezes a portion of the funds on the seller’s deposit until the transaction is executed or the position with the option is closed. GS can change immediately after the volatility of basic assets increases / decreases.

If the price of the underlying asset moves against the seller, he must make additional collateral if he will continue to hold this option or sell it. This process is governed by exchanges in automatic mode. If the option seller

does not have enough money in his account, the exchange will automatically liquidate this option position.

Exchange sets limits on the maximum number of options that can be taken on one side of the market. This protects the exchange of the situation when due to strong market movements in one direction, it cannot quickly close the option from the seller whose deposits fall below GS.

CCIN Token CCIN Token

will be placed during ICO. Their total is completely fixed. All tokens that are not redeemed during placement will be destroyed. They will never be issued again. They will be placed using Ethereum’s smart contract. The number of CCIN tokens that still guarantee their buyers increase their value when the exchange income grows. Tokens will be introduced to cryptocurrency exchanges within 30 days after the end of the ICO.

CRYPTOCOIN INSURANCE Company has developed a simple and understandable model for increasing the value of CCIN tokens. 30% of every commission earned by the exchange of options will be directed to the liquidity fund. In the following month CRYPTOCOIN INSURANCE sent this fund to buy CCIN tokens from the market and burn them.

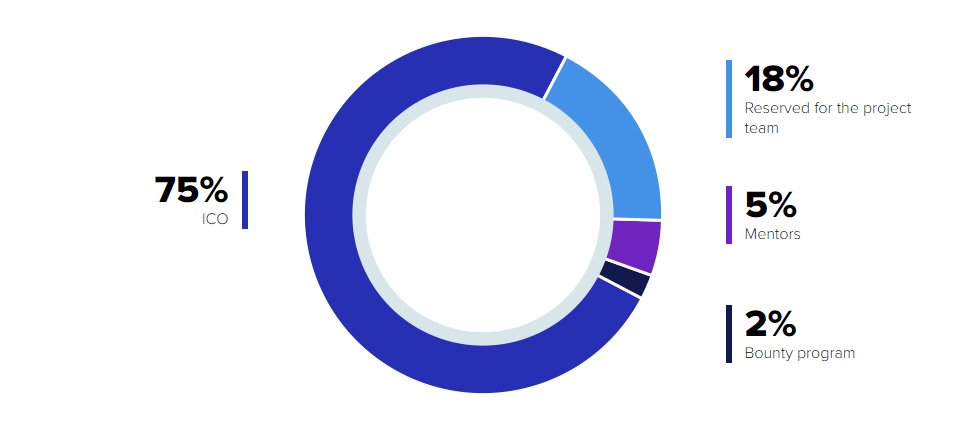

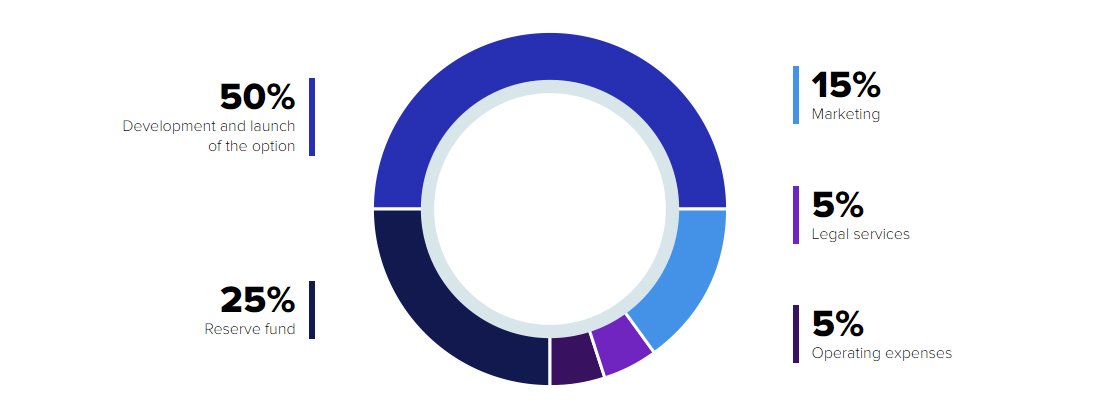

ICO Structure

Price of tokens: 3,000 tokens CCIN = 1 ETH

ICO date: 1 November 2018 – 27 December 2018

Minimum collection amount: $ 0.5 M

ICO main target: $ 5 М

Maximum collection amount: $ 10 M

All tokens that are not purchased when placed are destroyed. CCIN tokens are purchased using Bitcoin or Ethereum.

Token Allocation

Allocation of funds collected

Roadmap

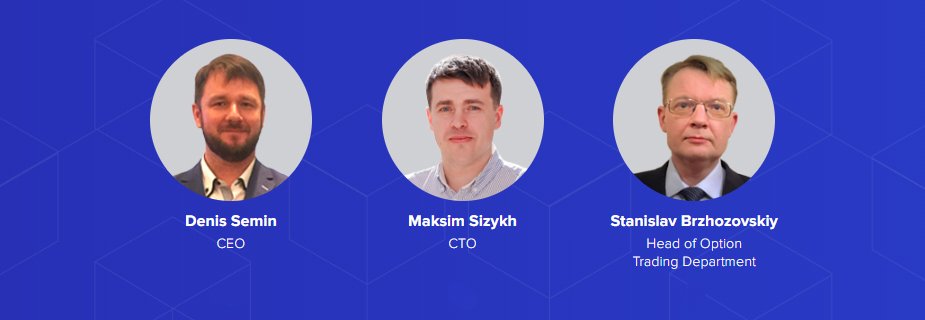

Team project

For more information:

Website: http://ccin.io/

Whitepaper: http://ccin.io/doc/Whitepapereng.pdf

Ann Thread: https://bitcointalk.org/index.php?topic=4948618

Telegram: https://t.me/ccin_official

Twitter: https://twitter.com/ccin_official

Facebook: https://www.facebook.com/ccinofficial/

Medium: https://medium.com/@ccin_official

Username:Asarb

Link: https://bitcointalk.org/index.php?action=profile;u=2320820

Tidak ada komentar:

Posting Komentar