2017 is a crazy year in cryptocurrency with digital tokens increasing about 5.6 billion dollars. In 2018 ICO is still booming even though it has turned into a year when trying to comply with US regulations or deciding to completely avoid everything. According to a report by PwC Switzerland, between January and May 2018, the ICO volume has doubled from that during 2017.

Security or Utility Tokens?

The majority of tokens released in 2017 are claimed as utility tokens to avoid friction with the SEC but in fact, they are security tokens.

Utility Token

Utility tokens are also referred to as application tokens, gift tokens or user tokens. These tokens are usually issued by companies to fund the development of their projects, the services or products they offer. The value of utility tokens is measured against the value of utilizing their concepts in the future.

There are some good use cases for utility tokens (games, gifts, use of software, etc.) but if your eyes start glazing in confusion listening to the structure of a person's token and how it works - or if they have to show you a detailed diagram of the tokens ecosystem they make it reasonable, or if they make interesting claims (too good to be true) you might see shitcoin or bullshit tokens.

According to Manzo Porelli in the Urban Dictionary, shitcoin or shit coin is "A cryptocurrency without unique utilities or features." And according to Bustapost, also in the Urban Dictionary, the use of the right term in the sentence "See that person there, in the fridge box? Lost everything in the 2018 shitcoin accident."

Many projects require economies of scale to make projects successful, meaning they need the real world to adopt them, and ultimately end users don't care, in large part, if you are a decentralized application or even built on the blockchain. without having to take my US dollar, open a digital wallet, buy new crypto currencies and, after bank verification, etc.

To clarify - security tokens it is not necessarily better to invest than utility tokens or vice versa. Research is very important in any investment decision and you should not invest if you cannot lose it all.

Security tokens

Security tokens are generally supported by real assets such as equity, limited partnership company shares, or commodities. Holders of security tokens can be given ownership rights or company shares. Security tokens have been developed to empower traditional initial public offerings (IPOs) above blockchain technology. Security tokens are also subject to federal regulations.

Security tokens are used to pay dividends, share profits, pay interest, or invest in tokens or other assets to generate profits for token holders. This is a financial instrument that can be traded with monetary value. Public Equity, Personal Equity, Real Estate, Managed Funds, Traded Funds, Bonds are common examples of security tokens.

What most people outside the cryptocurrency industry heard when they heard the news about how many millions of dollars crypto could be recovered or what they heard about the many 'projects' that had collected dollars and then projects failed miserably. This is why many people in this industry are passionate about security and regulations around them. They feel that STO will help legitimize this industry.

The power of the blockchain will provide much-needed change for industry and innovators, traditional investors and growing companies for a completely new market for wealth creation and changing the way the financial world is democratized.

There are many benefits in combining the current stock / financial market with crypto through security stores, including increased risk of being sold and traded internationally and projects can attract more investors around the world.

Security tokens can be real estate, funds, hotels, licensing, restaurant chains, etc. It would be interesting to see what tokens for the following year.

as is the case with FABA

when I write this article FABA has made ICO sales which will expire on January 31, 2019, you can visit the sales here

To join ico click here

ICO

(FABA) 1st ICO round token value: $ 1

(FABA) 2nd ICO round token value in: $ 1.3

Total number of Faba tokens: 160M (FABA) tokens

PRE ICO + ICO sale: 80M (FABA) tokens

ICO Hardcap $ 67.5M

ICO Softcap $ 4M

Investment to startups: $ 60.95M

Min. investment: $ 200 - 1st round, $ 1300 - 2nd round

Duration of ICO raising: 12 months, 2 rounds

0x0a1d2ff7156a48131553cf381f220bbedb4efa37

ETH Address for FABA tokens payment

0xB5B50277f772FecA093d5E389e7dFAA94Cb9CFD6

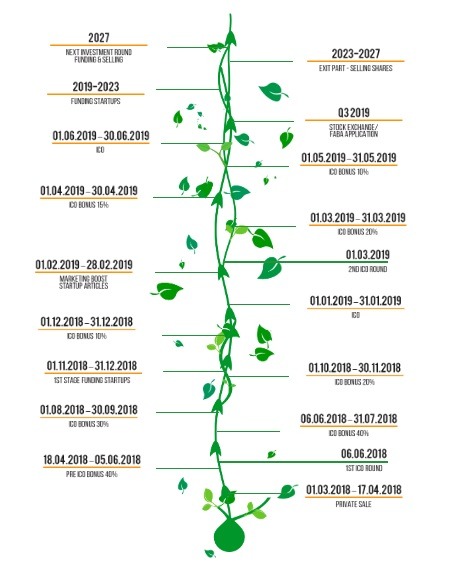

ROADMAP

TEAM

For more detail information, visit Official:

Website : https://vc.fabainvest.com/

Whitrpaper : https://www.faba-white-paper.com/FABA.pdf

Facebook : https://www.facebook.com/fabainvest/

Twitter : https://twitter.com/FabaInvest

Author : Asarab

Eth Address : 0x154089cb313479C0d698Fad2D29eFb9a71d67bo6

Tidak ada komentar:

Posting Komentar