We Believe that Demand for desired acquisition of Crypto Assets can be fulfilled with significant Supply of various Crypto Asset Holdings and negotiated directly by Trader Peers.

In addition, we believe market now demands for ability to hedge crypto assets for a short period of time to acquire other Crypto holdings. While it is difficult to implement margin trades and options in the true P2P environment, BQT Team developed innovative and yet more powerful tool to allow traders generate short term Hedge Trades.

The aim of BQT is to build a community and culture of Crypto Traders utilizing the Platform, helping the community and benefiting from the community.

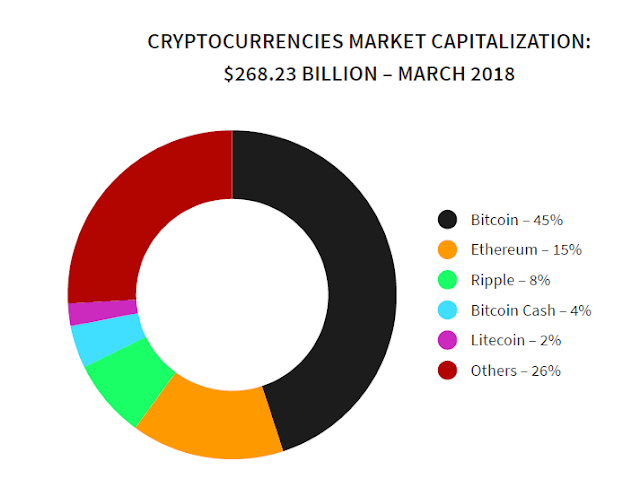

The cryptocurrency market is evolving, and its market capitalization was estimated to

US$268.23 billion on March 31st, 2018.

Since the introduction of Bitcoin in January 2009, thousands of cryptocurrencies have existed

at some point and today, there are hundreds of cryptocurrencies with a market value

that are being traded. Still, Bitcoin is the undoubtful leader representing approx. 45% of

the total market capitalization.

The current number of unique active users of cryptocurrency wallets is estimated to be between 2.9 million and 5.8 million, according to the latest report by Cambridge Centre for Alternative Finance.

Although it is almost impossible to know precisely how many people use cryptocurrency, using data obtained from study participants and assuming that an individual holds on average two wallets, Cambridge Centre for Alternative Finance estimated that there were between 2.9 million and 5.8 million unique users actively using a cryptocurrency wallet in 2017.

A multitude of projects and companies have emerged to provide products and services that facilitate the use of cryptocurrency for mainstream users and build the infrastructure for applications running on top of public blockchains.

While the cryptocurrency industry is composed of many important actors and groups, there are four key cryptocurrency industry sectors today:

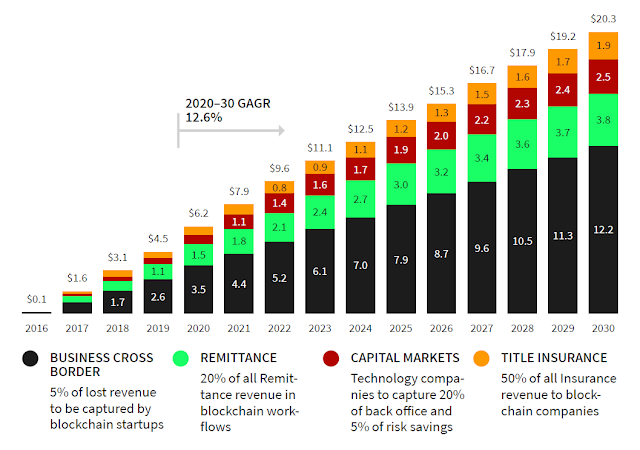

Blockchain technology is conquering the world and it completely transforms the way many markets operate. It is estimated that blockchain companies could experience a revenue pool of $6 billion by 2020 and $20 billion by 2030.

These figures are based on the impact of digital ledger technology on payments:

(1) Business Cross Border, (2) Remittance, as well as the impact on (3) Capital Markets and (4) Title Insurance.

The increasing adoption of digital currency will put downward pressure on remittance payments shifting 20% of revenue to Blockchain companies. This is projected to account for $1.5 billion (24%) of Blockchain revenue in 2020 and $3.8 billion (19%) in 2030.

Remaining revenue is captured by the reduction of infrastructure and counterparty risk for

capital markets, as well as savings in Title Insurance commissions and maintenance cost.

In the period 2020-2030, a Compound Annual Growth Rate (CAGR) of 12.6% is estimated

for the Blockchain technology market.

In today’s world Crypto Exchanges provide services to buy and sell cryptocurrencies and other digital assets for national currencies and other cryptocurrencies and play an essential role in the cryptocurrency economy by offering a marketplace for trading, liquidity, and price discovery.

Statistical study suggests:

While global cryptocurrency trading volume is dominated by four reserve currencies, trading in at least 40 other national currencies is supported the exchange market is dominated by a handful of exchanges that are responsible for the majority of global bitcoin trading volumes, of which the lion share is denominated in a small number of international currencies. In contrast, the majority of exchanges (mostly small) specialize in local markets by supporting local currencies: 53% of all exchanges support national currencies other than the five reserve currencies. Trading volumes at most small exchanges are insignificant compared to the market leaders, but these exchanges service local markets and make cryptocurrencies more available in many countries.

Following chart compiled by Bitcoinity shows the trends of FIAT currency trading given the recent China regulatory restrictions and RNB trading significantly dropping.

Small Exchanges are specializing mostly in one trading activity while most Large Exchanges active with multiple exchange features.

Europe is dominating the market and with China restrictions many exchanges, including a leading Asia exchange – Binance – is planning to relocate to Europe.

Cambridge study shows that only 22% of large exchanges and 4% of small exchanges offer a platform that includes an order-book exchange, trading platform and brokerage services. Over 40% of small exchanges specialize in the provision of P2P brokerage services, compared to only 17% of large exchanges. While 15% of small exchanges provide a standalone trading platform comparing to large exchanges which generally combine this activity with an order-book exchange.

P2P exchanges have yet to gain more popularity but still only 2 of the 51 of the P2P exchanges provide a decentralized marketplace for exchanging cryptocurrencies. All exchanges support bitcoin, while Ethereum and Litecoin for comparison are listed on only 40% of exchanges. Only a minority of exchanges make markets for the exchange of cryptocurrencies other than the above three.

While 39% of exchanges solely support bitcoin, 25% have two listed cryptocurrencies, and 36% of all entities enable trading three or more cryptocurrencies.

Another intriguing observation shows that 72% of large exchanges provide trading support for two or more cryptocurrencies, while 73% of small exchanges have only one or two cryptocurrencies listed. 6% of survey participants also provide cryptocurrency-based derivatives, and 16% are offering margin trading.

ERC-20 Post ICO Tokens gain more momentum on Exchange listings lately. Those that offer innovation on Blockchain, popularity among investors and consumer utilization are likely to get listed on large exchanges while others tend to show on various smaller platforms.

Cambridge study also shows that Small exchanges seem to have considerable difficulties with either obtaining or maintaining banking relationships, while large exchanges appear to have this risk factor under control. Small exchanges are also substantially more concerned about fraud than large exchanges, which suggests that they are either targeted more often than large exchanges or simply that fraud has more a more severe financial impact due to the limited scale of their operations and budget.

BQT is launching its Initial Coin Offering (ICO) campaign in July, 2018 issuing 200,000,000 ERC20 tokens (BQTX), minted at the end of an ICO.

BQT would charge 1% transaction fee for the instant trades and 3% escrow fee for Hedge Trades. All fees are payable ONLY with BQTX tokens to ensure the liquidity and utilization for the tokens. In addition, the BQTX tokens can be used as escrow collateral for some trades or added as additional collateral.

50% of the Fees would be shared quarterly during the first 3 years of Exchange operations as follows:

* Total 800,000,000 Tokens Authorized, 200,000,000 Tokens Issued during ICO, 600,000,000 tokens will be frozen and would only be released as needed for company expansion, marketing and loyalty programs to maintain token liquidity (up to 10% per year).

In addition, access to the marketplace will let its members purchase products and services posted by its affiliates and other members.

During the pre-boarding/pre-ICO period, every crowd investor will be granted BQTX tokens for sharing this opportunity with their friends on social media.

The Ethereum Blockchain API makes it effortless for anyone to quickly adapt their services and to reach a tremendous untapped audience of the BQT community and beyond.

PRE-ICO: BQTX tokens will be distributed based on the whitelisting-priority model. The pre-ICO whitelisting process will take 2 weeks after which Tokens will be offered for sale during 1 Day of Pre-ICO sale to registered individuals/entities which were approved during the whitelisting process.

ICO: BQTX tokens will be distributed based on the whitelisting-priority model. The ICO whitelisting process will take 6-8 weeks after which Tokens will be offered for sale during 1-3 Days of ICO sale to registered individuals/entities which were approved during the whitelisting process.

Bonuses will be awarded based on the day of the whitelisting registration, total tokens sold and amount of investment. Here are the terms of the ICO bonus structure:

Due to the high utilization expectations and the need for expansion capital, the Company will freeze the majority of the tokens (600,000,000) and only release up to 10% per year if necessary for company expansion, Marketing and Loyalty Programs to maintain token liquidity.

Company Management and Founders will reserve 20% of the tokens with 3 years-time based lock-up provisions.

The Company will reserve 28% of tokens only if there is a need for additional expansion capital during the first year of operation. Those unused tokens will be frozen otherwise. 2% of Tokens will be allocated for Advisors and Bounty programs.

Most proceeds from the sale will be allocated for Marketing and Expansion purposes and 20% of proceeds will be allocated to complete the testing and release of Beta and future versions of BQT technology. All ICO Crowdsale investors will receive first invitations to the Closed Beta release prior to the Beta market release.

Exchanges provide on-off ramps for users wishing to buy or sell cryptocurrency. The exchange sector is the first to have emerged in the cryptocurrency industry and remains the largest sector both in terms of the number of companies and employees.While many Blockchain experts are trying to find more ways to marry CRYPTO with FIAT, BQT Team believes in reducing dependency on FIAT altogether. Every Crypto Asset has its value and can be used as negotiating tool to acquire another Crypto Asset. We believe that Demand for desired acquisition of Crypto Assets can be fulfilled with significant Supply of various Crypto asset holdings and negotiated directly by trader peers.

2017 Global Crypto Currency Benchmarking Study, Cambridge Center of Alternative Finance

In addition, we believe market now demands for ability to hedge crypto assets for a short period of time to acquire other Crypto holdings. While it is difficult to implement margin trades and options in the true P2P environment, BQT Team developed innovative and yet more powerful tool to allow traders generate short term Hedge Trades.

The aim of BQT is to build a community and culture of Crypto Traders utilizing the Platform, helping the community and benefiting from the community.

CRYPTOCURRENCY MARKET

US$268.23 billion on March 31st, 2018.

Since the introduction of Bitcoin in January 2009, thousands of cryptocurrencies have existed

at some point and today, there are hundreds of cryptocurrencies with a market value

that are being traded. Still, Bitcoin is the undoubtful leader representing approx. 45% of

the total market capitalization.

The current number of unique active users of cryptocurrency wallets is estimated to be between 2.9 million and 5.8 million, according to the latest report by Cambridge Centre for Alternative Finance.

Although it is almost impossible to know precisely how many people use cryptocurrency, using data obtained from study participants and assuming that an individual holds on average two wallets, Cambridge Centre for Alternative Finance estimated that there were between 2.9 million and 5.8 million unique users actively using a cryptocurrency wallet in 2017.

THE ESTIMATED NUMBER OF UNIQUE ACTIVE USERS OF CRYPTOCURRENCY WALLETS

HAS GROWN SIGNIFICANTLY SINCE 2013 TO BETWEEN 2.9 MILLION

AND 5.8 MILLION TODAY

HAS GROWN SIGNIFICANTLY SINCE 2013 TO BETWEEN 2.9 MILLION

AND 5.8 MILLION TODAY

A multitude of projects and companies have emerged to provide products and services that facilitate the use of cryptocurrency for mainstream users and build the infrastructure for applications running on top of public blockchains.

While the cryptocurrency industry is composed of many important actors and groups, there are four key cryptocurrency industry sectors today:

- Exchanges

- Wallets

- Payments Companies

- Mining

BLOCKCHAIN TECHNOLOGY: STABLE AND EXPANDING

The blockchain is a decentralized ledger of all transactions across a peer-to-peer network. Using this technology, participants can confirm transactions without the need of a central certifying authority. Potential applications include fund transfers, selling trades, voting, and many other uses.

Alan Morrison and Subhankar Sinha, PWC, "A primer on blockchain"

Blockchain technology is conquering the world and it completely transforms the way many markets operate. It is estimated that blockchain companies could experience a revenue pool of $6 billion by 2020 and $20 billion by 2030.

These figures are based on the impact of digital ledger technology on payments:

(1) Business Cross Border, (2) Remittance, as well as the impact on (3) Capital Markets and (4) Title Insurance.

BLOCKCHAIN TECHNOLOGY REVENUE POOL ($ BILLIONS)

The increasing adoption of digital currency will put downward pressure on remittance payments shifting 20% of revenue to Blockchain companies. This is projected to account for $1.5 billion (24%) of Blockchain revenue in 2020 and $3.8 billion (19%) in 2030.

Remaining revenue is captured by the reduction of infrastructure and counterparty risk for

capital markets, as well as savings in Title Insurance commissions and maintenance cost.

In the period 2020-2030, a Compound Annual Growth Rate (CAGR) of 12.6% is estimated

for the Blockchain technology market.

WORLD CRYPTO EXCHANGES: A GROWING MARKET

Exchanges provide on-off ramps for users wishing to buy or sell cryptocurrency. The exchange sector is the first to have emerged in the cryptocurrency industry and remains the largest sector both in terms of the number of companies and employees.Exchanges were one of the first services to emerge in the cryptocurrency industry: while the first exchange was founded in early 2010 as a project to enable early users to trade bitcoin and thereby establish a market price.

2017 Global Crypto Currency Benchmarking Study, Cambridge Center of Alternative Finance

In today’s world Crypto Exchanges provide services to buy and sell cryptocurrencies and other digital assets for national currencies and other cryptocurrencies and play an essential role in the cryptocurrency economy by offering a marketplace for trading, liquidity, and price discovery.

Statistical study suggests:

- Crypto exchange sector has the highest number of operating entities and employs the most people. Over 52% of small exchanges hold a formal government license comparing to 35% of large exchanges.

- 73% of small exchanges have one or two cryptocurrencies listed, while 72% of large exchanges provide trading support for two or more cryptocurrencies: bitcoin is supported by all exchanges, followed by ether (43%) and litecoin (35%).

- A handful of large exchanges and four national currencies (USD, EUR, JPY and CNY) dominate global cryptocurrency trading volumes while trading in 42 different national currencies.

- 53% of exchanges support national currencies other than the five global reserve currencies (USD, CNY, EUR, GBP, JPY).

- Exchange services/activities fall into three categories: order-book exchanges, brokerage services and trading platforms while 72% of small exchanges specialize in one type of exchange activity (brokerage services being the most widely offered), while the same percentage of large exchanges are providing multiple exchange activities.

- 73% of exchanges take custody of user funds, 23% let users control keys

While global cryptocurrency trading volume is dominated by four reserve currencies, trading in at least 40 other national currencies is supported the exchange market is dominated by a handful of exchanges that are responsible for the majority of global bitcoin trading volumes, of which the lion share is denominated in a small number of international currencies. In contrast, the majority of exchanges (mostly small) specialize in local markets by supporting local currencies: 53% of all exchanges support national currencies other than the five reserve currencies. Trading volumes at most small exchanges are insignificant compared to the market leaders, but these exchanges service local markets and make cryptocurrencies more available in many countries.

Following chart compiled by Bitcoinity shows the trends of FIAT currency trading given the recent China regulatory restrictions and RNB trading significantly dropping.

BTC EXCHANGE TRADING VOLUME SHARE BY NATIONAL CURRENCY

Small Exchanges are specializing mostly in one trading activity while most Large Exchanges active with multiple exchange features.

Cambridge study shows that only 22% of large exchanges and 4% of small exchanges offer a platform that includes an order-book exchange, trading platform and brokerage services. Over 40% of small exchanges specialize in the provision of P2P brokerage services, compared to only 17% of large exchanges. While 15% of small exchanges provide a standalone trading platform comparing to large exchanges which generally combine this activity with an order-book exchange.

P2P exchanges have yet to gain more popularity but still only 2 of the 51 of the P2P exchanges provide a decentralized marketplace for exchanging cryptocurrencies. All exchanges support bitcoin, while Ethereum and Litecoin for comparison are listed on only 40% of exchanges. Only a minority of exchanges make markets for the exchange of cryptocurrencies other than the above three.

While 39% of exchanges solely support bitcoin, 25% have two listed cryptocurrencies, and 36% of all entities enable trading three or more cryptocurrencies.

Another intriguing observation shows that 72% of large exchanges provide trading support for two or more cryptocurrencies, while 73% of small exchanges have only one or two cryptocurrencies listed. 6% of survey participants also provide cryptocurrency-based derivatives, and 16% are offering margin trading.

ERC-20 Post ICO Tokens gain more momentum on Exchange listings lately. Those that offer innovation on Blockchain, popularity among investors and consumer utilization are likely to get listed on large exchanges while others tend to show on various smaller platforms.

Cambridge study also shows that Small exchanges seem to have considerable difficulties with either obtaining or maintaining banking relationships, while large exchanges appear to have this risk factor under control. Small exchanges are also substantially more concerned about fraud than large exchanges, which suggests that they are either targeted more often than large exchanges or simply that fraud has more a more severe financial impact due to the limited scale of their operations and budget.

BQT INITIAL COIN OFFERING (ICO)

BQT would charge 1% transaction fee for the instant trades and 3% escrow fee for Hedge Trades. All fees are payable ONLY with BQTX tokens to ensure the liquidity and utilization for the tokens. In addition, the BQTX tokens can be used as escrow collateral for some trades or added as additional collateral.

50% of the Fees would be shared quarterly during the first 3 years of Exchange operations as follows:

- 20% to ICO Initial Token Holders

- 15% to Top Traders

- 15% to Referral Affiliate Partners

BQTX-TOKEN STRUCTURE

200,000,000 BQTX TOKENS WILL BE ISSUED DURING ICO *

800 BQTX TOKENS = 1 ETH

800 BQTX TOKENS = 1 ETH

* Total 800,000,000 Tokens Authorized, 200,000,000 Tokens Issued during ICO, 600,000,000 tokens will be frozen and would only be released as needed for company expansion, marketing and loyalty programs to maintain token liquidity (up to 10% per year).

FOR MEMBERS

Using the potential of the BQT community, its users will get quick access to tools and cryptocurrency to assist with their daily needs. They will have the ability to borrow, lend, save and pay for goods and services protected by Blockchain security.In addition, access to the marketplace will let its members purchase products and services posted by its affiliates and other members.

During the pre-boarding/pre-ICO period, every crowd investor will be granted BQTX tokens for sharing this opportunity with their friends on social media.

FOR PARTNERS/BQTX-COIN HOLDERS

BQT ICO will be traded on the Ethereum Blockchain Platform and will bring dedicated partners sharing distributed digital assets via its cryptocurrency instead of the burden of an expensive traditional IPO. BQT APIs will be available for its community of entrepreneurs, startups and other businesses to sell their products and services using its technology to stimulate the growing crypto-economy even further.The Ethereum Blockchain API makes it effortless for anyone to quickly adapt their services and to reach a tremendous untapped audience of the BQT community and beyond.

BONUSES

BQTX tokens will be distributed based on the whitelisting-priority model. The ICO whitelisting process will start after the private institutional sale.PRE-ICO: BQTX tokens will be distributed based on the whitelisting-priority model. The pre-ICO whitelisting process will take 2 weeks after which Tokens will be offered for sale during 1 Day of Pre-ICO sale to registered individuals/entities which were approved during the whitelisting process.

ICO: BQTX tokens will be distributed based on the whitelisting-priority model. The ICO whitelisting process will take 6-8 weeks after which Tokens will be offered for sale during 1-3 Days of ICO sale to registered individuals/entities which were approved during the whitelisting process.

Bonuses will be awarded based on the day of the whitelisting registration, total tokens sold and amount of investment. Here are the terms of the ICO bonus structure:

TOKEN DISTRIBUTION

Due to the high utilization expectations and the need for expansion capital, the Company will freeze the majority of the tokens (600,000,000) and only release up to 10% per year if necessary for company expansion, Marketing and Loyalty Programs to maintain token liquidity.

BQTX TOKEN DISTRIBUTION POST-ICO (EXCLUDING FROZEN TOKENS)

Company Management and Founders will reserve 20% of the tokens with 3 years-time based lock-up provisions.

The Company will reserve 28% of tokens only if there is a need for additional expansion capital during the first year of operation. Those unused tokens will be frozen otherwise. 2% of Tokens will be allocated for Advisors and Bounty programs.

FUNDS ALLOCATION

Most proceeds from the sale will be allocated for Marketing and Expansion purposes and 20% of proceeds will be allocated to complete the testing and release of Beta and future versions of BQT technology. All ICO Crowdsale investors will receive first invitations to the Closed Beta release prior to the Beta market release.

We Believe that Demand for desired acquisition of Crypto Assets can be fulfilled with significant Supply of various Crypto Asset Holdings and negotiated directly by Trader Peers.

In addition, we believe market now demands for ability to hedge crypto assets for a short period of time to acquire other Crypto holdings. While it is difficult to implement margin trades and options in the true P2P environment, BQT Team developed innovative and yet more powerful tool to allow traders generate short term Hedge Trades.

The aim of BQT is to build a community and culture of Crypto Traders utilizing the Platform, helping the community and benefiting from the community.

The cryptocurrency market is evolving, and its market capitalization was estimated to

US$268.23 billion on March 31st, 2018.

Since the introduction of Bitcoin in January 2009, thousands of cryptocurrencies have existed

at some point and today, there are hundreds of cryptocurrencies with a market value

that are being traded. Still, Bitcoin is the undoubtful leader representing approx. 45% of

the total market capitalization.

The current number of unique active users of cryptocurrency wallets is estimated to be between 2.9 million and 5.8 million, according to the latest report by Cambridge Centre for Alternative Finance.

Although it is almost impossible to know precisely how many people use cryptocurrency, using data obtained from study participants and assuming that an individual holds on average two wallets, Cambridge Centre for Alternative Finance estimated that there were between 2.9 million and 5.8 million unique users actively using a cryptocurrency wallet in 2017.

A multitude of projects and companies have emerged to provide products and services that facilitate the use of cryptocurrency for mainstream users and build the infrastructure for applications running on top of public blockchains.

While the cryptocurrency industry is composed of many important actors and groups, there are four key cryptocurrency industry sectors today:

Blockchain technology is conquering the world and it completely transforms the way many markets operate. It is estimated that blockchain companies could experience a revenue pool of $6 billion by 2020 and $20 billion by 2030.

These figures are based on the impact of digital ledger technology on payments:

(1) Business Cross Border, (2) Remittance, as well as the impact on (3) Capital Markets and (4) Title Insurance.

The increasing adoption of digital currency will put downward pressure on remittance payments shifting 20% of revenue to Blockchain companies. This is projected to account for $1.5 billion (24%) of Blockchain revenue in 2020 and $3.8 billion (19%) in 2030.

Remaining revenue is captured by the reduction of infrastructure and counterparty risk for

capital markets, as well as savings in Title Insurance commissions and maintenance cost.

In the period 2020-2030, a Compound Annual Growth Rate (CAGR) of 12.6% is estimated

for the Blockchain technology market.

In today’s world Crypto Exchanges provide services to buy and sell cryptocurrencies and other digital assets for national currencies and other cryptocurrencies and play an essential role in the cryptocurrency economy by offering a marketplace for trading, liquidity, and price discovery.

Statistical study suggests:

While global cryptocurrency trading volume is dominated by four reserve currencies, trading in at least 40 other national currencies is supported the exchange market is dominated by a handful of exchanges that are responsible for the majority of global bitcoin trading volumes, of which the lion share is denominated in a small number of international currencies. In contrast, the majority of exchanges (mostly small) specialize in local markets by supporting local currencies: 53% of all exchanges support national currencies other than the five reserve currencies. Trading volumes at most small exchanges are insignificant compared to the market leaders, but these exchanges service local markets and make cryptocurrencies more available in many countries.

Following chart compiled by Bitcoinity shows the trends of FIAT currency trading given the recent China regulatory restrictions and RNB trading significantly dropping.

Small Exchanges are specializing mostly in one trading activity while most Large Exchanges active with multiple exchange features.

Europe is dominating the market and with China restrictions many exchanges, including a leading Asia exchange – Binance – is planning to relocate to Europe.

Cambridge study shows that only 22% of large exchanges and 4% of small exchanges offer a platform that includes an order-book exchange, trading platform and brokerage services. Over 40% of small exchanges specialize in the provision of P2P brokerage services, compared to only 17% of large exchanges. While 15% of small exchanges provide a standalone trading platform comparing to large exchanges which generally combine this activity with an order-book exchange.

P2P exchanges have yet to gain more popularity but still only 2 of the 51 of the P2P exchanges provide a decentralized marketplace for exchanging cryptocurrencies. All exchanges support bitcoin, while Ethereum and Litecoin for comparison are listed on only 40% of exchanges. Only a minority of exchanges make markets for the exchange of cryptocurrencies other than the above three.

While 39% of exchanges solely support bitcoin, 25% have two listed cryptocurrencies, and 36% of all entities enable trading three or more cryptocurrencies.

Another intriguing observation shows that 72% of large exchanges provide trading support for two or more cryptocurrencies, while 73% of small exchanges have only one or two cryptocurrencies listed. 6% of survey participants also provide cryptocurrency-based derivatives, and 16% are offering margin trading.

ERC-20 Post ICO Tokens gain more momentum on Exchange listings lately. Those that offer innovation on Blockchain, popularity among investors and consumer utilization are likely to get listed on large exchanges while others tend to show on various smaller platforms.

Cambridge study also shows that Small exchanges seem to have considerable difficulties with either obtaining or maintaining banking relationships, while large exchanges appear to have this risk factor under control. Small exchanges are also substantially more concerned about fraud than large exchanges, which suggests that they are either targeted more often than large exchanges or simply that fraud has more a more severe financial impact due to the limited scale of their operations and budget.

BQT is launching its Initial Coin Offering (ICO) campaign in July, 2018 issuing 200,000,000 ERC20 tokens (BQTX), minted at the end of an ICO.

BQT would charge 1% transaction fee for the instant trades and 3% escrow fee for Hedge Trades. All fees are payable ONLY with BQTX tokens to ensure the liquidity and utilization for the tokens. In addition, the BQTX tokens can be used as escrow collateral for some trades or added as additional collateral.

50% of the Fees would be shared quarterly during the first 3 years of Exchange operations as follows:

* Total 800,000,000 Tokens Authorized, 200,000,000 Tokens Issued during ICO, 600,000,000 tokens will be frozen and would only be released as needed for company expansion, marketing and loyalty programs to maintain token liquidity (up to 10% per year).

In addition, access to the marketplace will let its members purchase products and services posted by its affiliates and other members.

During the pre-boarding/pre-ICO period, every crowd investor will be granted BQTX tokens for sharing this opportunity with their friends on social media.

The Ethereum Blockchain API makes it effortless for anyone to quickly adapt their services and to reach a tremendous untapped audience of the BQT community and beyond.

PRE-ICO: BQTX tokens will be distributed based on the whitelisting-priority model. The pre-ICO whitelisting process will take 2 weeks after which Tokens will be offered for sale during 1 Day of Pre-ICO sale to registered individuals/entities which were approved during the whitelisting process.

ICO: BQTX tokens will be distributed based on the whitelisting-priority model. The ICO whitelisting process will take 6-8 weeks after which Tokens will be offered for sale during 1-3 Days of ICO sale to registered individuals/entities which were approved during the whitelisting process.

Bonuses will be awarded based on the day of the whitelisting registration, total tokens sold and amount of investment. Here are the terms of the ICO bonus structure:

Due to the high utilization expectations and the need for expansion capital, the Company will freeze the majority of the tokens (600,000,000) and only release up to 10% per year if necessary for company expansion, Marketing and Loyalty Programs to maintain token liquidity.

Company Management and Founders will reserve 20% of the tokens with 3 years-time based lock-up provisions.

The Company will reserve 28% of tokens only if there is a need for additional expansion capital during the first year of operation. Those unused tokens will be frozen otherwise. 2% of Tokens will be allocated for Advisors and Bounty programs.

Most proceeds from the sale will be allocated for Marketing and Expansion purposes and 20% of proceeds will be allocated to complete the testing and release of Beta and future versions of BQT technology. All ICO Crowdsale investors will receive first invitations to the Closed Beta release prior to the Beta market release.

Exchanges provide on-off ramps for users wishing to buy or sell cryptocurrency. The exchange sector is the first to have emerged in the cryptocurrency industry and remains the largest sector both in terms of the number of companies and employees.While many Blockchain experts are trying to find more ways to marry CRYPTO with FIAT, BQT Team believes in reducing dependency on FIAT altogether. Every Crypto Asset has its value and can be used as negotiating tool to acquire another Crypto Asset. We believe that Demand for desired acquisition of Crypto Assets can be fulfilled with significant Supply of various Crypto asset holdings and negotiated directly by trader peers.

2017 Global Crypto Currency Benchmarking Study, Cambridge Center of Alternative Finance

In addition, we believe market now demands for ability to hedge crypto assets for a short period of time to acquire other Crypto holdings. While it is difficult to implement margin trades and options in the true P2P environment, BQT Team developed innovative and yet more powerful tool to allow traders generate short term Hedge Trades.

The aim of BQT is to build a community and culture of Crypto Traders utilizing the Platform, helping the community and benefiting from the community.

CRYPTOCURRENCY MARKET

US$268.23 billion on March 31st, 2018.

Since the introduction of Bitcoin in January 2009, thousands of cryptocurrencies have existed

at some point and today, there are hundreds of cryptocurrencies with a market value

that are being traded. Still, Bitcoin is the undoubtful leader representing approx. 45% of

the total market capitalization.

The current number of unique active users of cryptocurrency wallets is estimated to be between 2.9 million and 5.8 million, according to the latest report by Cambridge Centre for Alternative Finance.

Although it is almost impossible to know precisely how many people use cryptocurrency, using data obtained from study participants and assuming that an individual holds on average two wallets, Cambridge Centre for Alternative Finance estimated that there were between 2.9 million and 5.8 million unique users actively using a cryptocurrency wallet in 2017.

THE ESTIMATED NUMBER OF UNIQUE ACTIVE USERS OF CRYPTOCURRENCY WALLETS

HAS GROWN SIGNIFICANTLY SINCE 2013 TO BETWEEN 2.9 MILLION

AND 5.8 MILLION TODAY

HAS GROWN SIGNIFICANTLY SINCE 2013 TO BETWEEN 2.9 MILLION

AND 5.8 MILLION TODAY

A multitude of projects and companies have emerged to provide products and services that facilitate the use of cryptocurrency for mainstream users and build the infrastructure for applications running on top of public blockchains.

While the cryptocurrency industry is composed of many important actors and groups, there are four key cryptocurrency industry sectors today:

- Exchanges

- Wallets

- Payments Companies

- Mining

BLOCKCHAIN TECHNOLOGY: STABLE AND EXPANDING

The blockchain is a decentralized ledger of all transactions across a peer-to-peer network. Using this technology, participants can confirm transactions without the need of a central certifying authority. Potential applications include fund transfers, selling trades, voting, and many other uses.

Alan Morrison and Subhankar Sinha, PWC, "A primer on blockchain"

Blockchain technology is conquering the world and it completely transforms the way many markets operate. It is estimated that blockchain companies could experience a revenue pool of $6 billion by 2020 and $20 billion by 2030.

These figures are based on the impact of digital ledger technology on payments:

(1) Business Cross Border, (2) Remittance, as well as the impact on (3) Capital Markets and (4) Title Insurance.

BLOCKCHAIN TECHNOLOGY REVENUE POOL ($ BILLIONS)

The increasing adoption of digital currency will put downward pressure on remittance payments shifting 20% of revenue to Blockchain companies. This is projected to account for $1.5 billion (24%) of Blockchain revenue in 2020 and $3.8 billion (19%) in 2030.

Remaining revenue is captured by the reduction of infrastructure and counterparty risk for

capital markets, as well as savings in Title Insurance commissions and maintenance cost.

In the period 2020-2030, a Compound Annual Growth Rate (CAGR) of 12.6% is estimated

for the Blockchain technology market.

WORLD CRYPTO EXCHANGES: A GROWING MARKET

Exchanges provide on-off ramps for users wishing to buy or sell cryptocurrency. The exchange sector is the first to have emerged in the cryptocurrency industry and remains the largest sector both in terms of the number of companies and employees.Exchanges were one of the first services to emerge in the cryptocurrency industry: while the first exchange was founded in early 2010 as a project to enable early users to trade bitcoin and thereby establish a market price.

2017 Global Crypto Currency Benchmarking Study, Cambridge Center of Alternative Finance

In today’s world Crypto Exchanges provide services to buy and sell cryptocurrencies and other digital assets for national currencies and other cryptocurrencies and play an essential role in the cryptocurrency economy by offering a marketplace for trading, liquidity, and price discovery.

Statistical study suggests:

- Crypto exchange sector has the highest number of operating entities and employs the most people. Over 52% of small exchanges hold a formal government license comparing to 35% of large exchanges.

- 73% of small exchanges have one or two cryptocurrencies listed, while 72% of large exchanges provide trading support for two or more cryptocurrencies: bitcoin is supported by all exchanges, followed by ether (43%) and litecoin (35%).

- A handful of large exchanges and four national currencies (USD, EUR, JPY and CNY) dominate global cryptocurrency trading volumes while trading in 42 different national currencies.

- 53% of exchanges support national currencies other than the five global reserve currencies (USD, CNY, EUR, GBP, JPY).

- Exchange services/activities fall into three categories: order-book exchanges, brokerage services and trading platforms while 72% of small exchanges specialize in one type of exchange activity (brokerage services being the most widely offered), while the same percentage of large exchanges are providing multiple exchange activities.

- 73% of exchanges take custody of user funds, 23% let users control keys

While global cryptocurrency trading volume is dominated by four reserve currencies, trading in at least 40 other national currencies is supported the exchange market is dominated by a handful of exchanges that are responsible for the majority of global bitcoin trading volumes, of which the lion share is denominated in a small number of international currencies. In contrast, the majority of exchanges (mostly small) specialize in local markets by supporting local currencies: 53% of all exchanges support national currencies other than the five reserve currencies. Trading volumes at most small exchanges are insignificant compared to the market leaders, but these exchanges service local markets and make cryptocurrencies more available in many countries.

Following chart compiled by Bitcoinity shows the trends of FIAT currency trading given the recent China regulatory restrictions and RNB trading significantly dropping.

BTC EXCHANGE TRADING VOLUME SHARE BY NATIONAL CURRENCY

Small Exchanges are specializing mostly in one trading activity while most Large Exchanges active with multiple exchange features.

Cambridge study shows that only 22% of large exchanges and 4% of small exchanges offer a platform that includes an order-book exchange, trading platform and brokerage services. Over 40% of small exchanges specialize in the provision of P2P brokerage services, compared to only 17% of large exchanges. While 15% of small exchanges provide a standalone trading platform comparing to large exchanges which generally combine this activity with an order-book exchange.

P2P exchanges have yet to gain more popularity but still only 2 of the 51 of the P2P exchanges provide a decentralized marketplace for exchanging cryptocurrencies. All exchanges support bitcoin, while Ethereum and Litecoin for comparison are listed on only 40% of exchanges. Only a minority of exchanges make markets for the exchange of cryptocurrencies other than the above three.

While 39% of exchanges solely support bitcoin, 25% have two listed cryptocurrencies, and 36% of all entities enable trading three or more cryptocurrencies.

Another intriguing observation shows that 72% of large exchanges provide trading support for two or more cryptocurrencies, while 73% of small exchanges have only one or two cryptocurrencies listed. 6% of survey participants also provide cryptocurrency-based derivatives, and 16% are offering margin trading.

ERC-20 Post ICO Tokens gain more momentum on Exchange listings lately. Those that offer innovation on Blockchain, popularity among investors and consumer utilization are likely to get listed on large exchanges while others tend to show on various smaller platforms.

Cambridge study also shows that Small exchanges seem to have considerable difficulties with either obtaining or maintaining banking relationships, while large exchanges appear to have this risk factor under control. Small exchanges are also substantially more concerned about fraud than large exchanges, which suggests that they are either targeted more often than large exchanges or simply that fraud has more a more severe financial impact due to the limited scale of their operations and budget.

BQT INITIAL COIN OFFERING (ICO)

BQT would charge 1% transaction fee for the instant trades and 3% escrow fee for Hedge Trades. All fees are payable ONLY with BQTX tokens to ensure the liquidity and utilization for the tokens. In addition, the BQTX tokens can be used as escrow collateral for some trades or added as additional collateral.

50% of the Fees would be shared quarterly during the first 3 years of Exchange operations as follows:

- 20% to ICO Initial Token Holders

- 15% to Top Traders

- 15% to Referral Affiliate Partners

BQTX-TOKEN STRUCTURE

200,000,000 BQTX TOKENS WILL BE ISSUED DURING ICO *

800 BQTX TOKENS = 1 ETH

800 BQTX TOKENS = 1 ETH

* Total 800,000,000 Tokens Authorized, 200,000,000 Tokens Issued during ICO, 600,000,000 tokens will be frozen and would only be released as needed for company expansion, marketing and loyalty programs to maintain token liquidity (up to 10% per year).

FOR MEMBERS

Using the potential of the BQT community, its users will get quick access to tools and cryptocurrency to assist with their daily needs. They will have the ability to borrow, lend, save and pay for goods and services protected by Blockchain security.In addition, access to the marketplace will let its members purchase products and services posted by its affiliates and other members.

During the pre-boarding/pre-ICO period, every crowd investor will be granted BQTX tokens for sharing this opportunity with their friends on social media.

FOR PARTNERS/BQTX-COIN HOLDERS

BQT ICO will be traded on the Ethereum Blockchain Platform and will bring dedicated partners sharing distributed digital assets via its cryptocurrency instead of the burden of an expensive traditional IPO. BQT APIs will be available for its community of entrepreneurs, startups and other businesses to sell their products and services using its technology to stimulate the growing crypto-economy even further.The Ethereum Blockchain API makes it effortless for anyone to quickly adapt their services and to reach a tremendous untapped audience of the BQT community and beyond.

BONUSES

BQTX tokens will be distributed based on the whitelisting-priority model. The ICO whitelisting process will start after the private institutional sale.PRE-ICO: BQTX tokens will be distributed based on the whitelisting-priority model. The pre-ICO whitelisting process will take 2 weeks after which Tokens will be offered for sale during 1 Day of Pre-ICO sale to registered individuals/entities which were approved during the whitelisting process.

ICO: BQTX tokens will be distributed based on the whitelisting-priority model. The ICO whitelisting process will take 6-8 weeks after which Tokens will be offered for sale during 1-3 Days of ICO sale to registered individuals/entities which were approved during the whitelisting process.

Bonuses will be awarded based on the day of the whitelisting registration, total tokens sold and amount of investment. Here are the terms of the ICO bonus structure:

TOKEN DISTRIBUTION

Due to the high utilization expectations and the need for expansion capital, the Company will freeze the majority of the tokens (600,000,000) and only release up to 10% per year if necessary for company expansion, Marketing and Loyalty Programs to maintain token liquidity.

BQTX TOKEN DISTRIBUTION POST-ICO (EXCLUDING FROZEN TOKENS)

Company Management and Founders will reserve 20% of the tokens with 3 years-time based lock-up provisions.

The Company will reserve 28% of tokens only if there is a need for additional expansion capital during the first year of operation. Those unused tokens will be frozen otherwise. 2% of Tokens will be allocated for Advisors and Bounty programs.

FUNDS ALLOCATION

Most proceeds from the sale will be allocated for Marketing and Expansion purposes and 20% of proceeds will be allocated to complete the testing and release of Beta and future versions of BQT technology. All ICO Crowdsale investors will receive first invitations to the Closed Beta release prior to the Beta market release.

Tidak ada komentar:

Posting Komentar